Silver Lining: How Japan’s Ageing Population is Reshaping the Marketing Boom

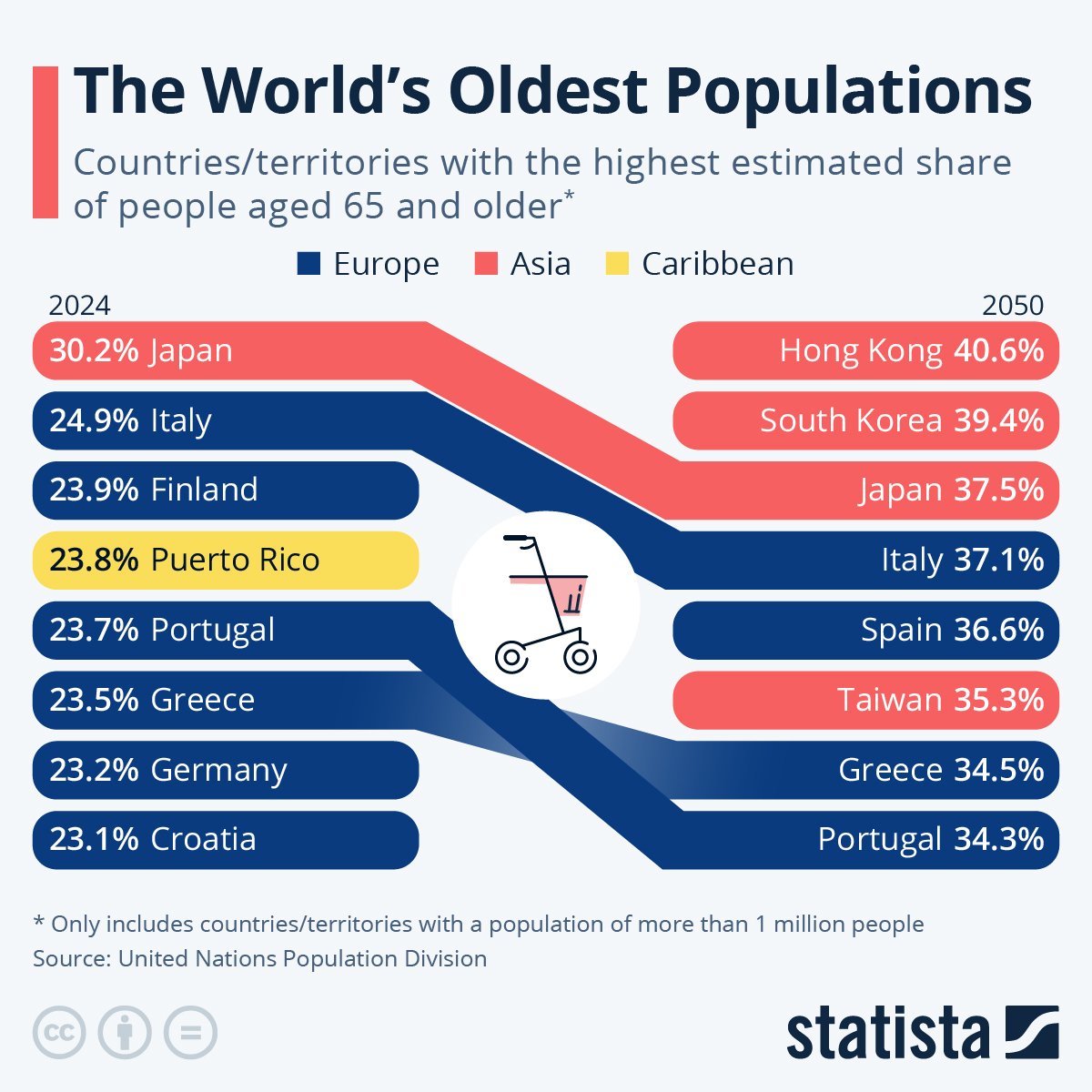

Japan boasts the world’s oldest population, with a staggering 28.7% of its citizens being 65 years or older. Over 10% of residents are now 80 or older, and the number of people over the age of 100 has crossed a whopping 80,000 individuals! This makes up an estimated 36.23 million people.

This demographic shift positions Japan as the world’s oldest country.

By 2036, a full third of the population will fall into the 65+ age bracket. Notably, women make up the majority of this age group.

Japan’s ageing population presents both challenges and opportunities for the nation. Social safety nets, healthcare systems, and workforce demographics will all need to adapt to this new reality. However, the experience and wisdom of older adults can also be a valuable resource for society.

Source: Statista

Impact of Ageing Population on Japan

The global shift towards an older population is shaping societies and economies worldwide. In Japan, this trend has significant consequences.

Economic Strain

The International Monetary Fund predicts that Japan’s public finances will be strained as age-related spending on healthcare and pensions rises while the tax base shrinks. While Japan remains the second-largest G7 economy with a GDP of around $4.2 trillion, Prime Minister Fumio Kishida has expressed concerns about the country's ability to function as a society due to declining birth rates and a growing elderly population.

Labour Shortage and Productivity

Japan already faces a labour shortage, projected to reach 11 million workers by 2040. This issue is not unique, but Japan’s response has been noteworthy. The 2018 Guideline of Measures for the Ageing Society encourages older workers to stay in the workforce, and in 2022, nearly half of Japanese firms relied on workers over 70. However, stricter immigration laws may slow down filling the labour gap despite government initiatives like Prime Minister Kishida’s $7.6 billion pledge for worker upskilling.

Shrinking Population and Social Security

Japan’s birth rate hit a record low in 2022, far below the replacement rate. The pandemic further exacerbated this challenge, leading to fewer marriages and births. This poses a significant threat to Japan’s social security system, which may struggle to meet the costs of a retired population with fewer workers paying taxes. This trend could lead to a decline in domestic demand and economic growth.

Healthcare Challenges

Given Japan’s ageing population, healthcare is an inevitable crunch point. The government has explored a move from hospitals to home care, encouraging patient-requested care, self-medication, and remote monitoring. While care robots have been tried, automation has not proven to be the complete solution Japan had hoped for.

Source: Freepik

Japan’s Silver Power: Marketing to Japan’s Seniors

By 2035, one in three people in Japan will be over 60. This trend shows no signs of slowing, making the senior market a reliable growth engine. Here’s how marketing to Japan’s seniors will shift in the coming time.

Financial Stability

Contrary to stereotypes, most Japanese seniors are financially comfortable. In fact, 65% of people aged 60 and over reported feeling very comfortable financially or having minimal financial worries. The Ministry of Health, Labour and Welfare shows that the average annual income for senior households reached a record high in 2017. Moreover, over 71.5% of those over 80 years old are never short on cash.

Retirement Age

Prime Minister Shinzo Abe seeks to abolish mandatory retirement ages in Japan. This aims to keep experienced workers employed longer and address the nation’s shrinking workforce and tax base.

Active, Affluent, and Tech-Savvy Seniors

The “silver market” isn’t just a collection of retirees; it’s a thriving consumer segment with distinct needs and desires. A report says that most 67 year olds confessed they felt not more than 53.

No wonder, the popularity of the 2016 book, Ikigai: The 100-Year Life: Living and Working in an Age of Longevity, rose to such popularity across the world.

Financially Independent and Health-Conscious

Unlike seniors in some countries, Japan’s older adults are financially secure. The post-war baby boom generation, in particular, holds significant wealth. Women, who make up nearly half of the senior population, are often the primary decision-makers when it comes to household purchases.

With the focus on health, mental sharpness, and physical fitness, Japan is a booming market for health and wellness products and services.

Brain Games and Fitness Centers

Products like Nintendo’s Brain Age capitalise on the desire to maintain cognitive function. Educational institutions are also adapting, with cram schools now offering lifelong learning programs specifically for seniors.

Fitness is another key area. Gyms like Curves and Renaissance are actively courting older adults with classes designed for functional movement and senior-friendly facilities. Notably, a high percentage of gym members in Japan are over 60, with women leading the charge.

Shopping Apps For Silver Economy

Recognising the value of community, retailers like Aeon have created senior-focused shopping centres. These one-stop shops combine essential services like healthcare checkups with exercise classes, cafes, and bookstores, fostering social interaction while encouraging spending.

Technology & E-Commerce:

Contrary to stereotypes, Japan’s seniors are surprisingly tech-savvy. Rakuten’s C2C platform Rakuma has seen a surge in usage among older adults, demonstrating their comfort with online marketplaces.

Manufacturers are also addressing the challenge of user-friendly devices with senior-oriented smartphones like Fujitsu’s RakuRaku model. As smartphone ownership continues to rise among seniors, investments in digital literacy programs could unlock even greater online spending potential.

Overall, Japan’s senior market presents a vibrant opportunity. By understanding their priorities for health, wellness, and social connection, businesses can develop products and services that cater to this powerful demographic.

Source: Reuters

Combating Loneliness and Promoting Independence: The Silver Market for Comfort and Care

While physical health is crucial, Japan’s silver market recognises the emotional needs of seniors as well. Social isolation and loneliness can significantly impact well-being, leading to mental decline.

Dating Sites: Dating sites like Aeon’s Begins Partner offer companionship opportunities specifically for seniors.

Robotic Companions: Japan’s strong embrace of robotics has led to innovative options. Sony’s Aibo robotic dog provides companionship without the physical demands of caring for a live animal. Newer models like Paro, a therapeutic baby seal, and Lovot, a cuddly robot with responsive fur and sensors, offer a level of “skinship” (emotional closeness through touch) that earlier models lacked.

Meal Solutions: Ready-made meals and delivery services like those offered by FamilyMart convenience stores are a boon for seniors, particularly those living alone and lacking the desire to cook. It also extends to medication delivery.

Fall Prevention: Terumo’s Upwalk socks automatically lift the wearer’s toes, helping prevent falls caused by catching on uneven surfaces.

Smart Canes: Fujitsu’s Next Generation smart walking sticks are packed with features to promote safety. Equipped with Bluetooth, GPS, and sensors that monitor vitals, these high-tech canes can send alerts to caregivers if a senior goes off course. They even offer two-way communication for added security.

Senior-Friendly Cars: Car manufacturers like Honda are designing vehicles with seniors in mind. The N-Box minicar is a prime example. Featuring error-detection pedals and automatic emergency braking, this car has become a top seller due to its safety features, with nearly half of owners being over 50. These advancements pave the way for continued independence, especially in rural areas where public transportation is limited.

The emphasis on safe mobility and user-friendly technology highlights a key trend in the silver market: empowering seniors to maintain independence and well-being for as long as possible. As technology like autonomous vehicles evolves, we can expect even more innovative solutions to address the needs of this growing demographic.

Source: Freepik

How Japan Is Coping With A Greying Nation

Japan’s low birthrate and ageing population pose an urgent risk to society, the country’s prime minister, Fumio Kishida, has said, as he pledged to address the issue by establishing a new government agency.

“The number of births dropped below 800,000 last year, according to estimates,” Kishida told lawmakers in a policy address marking the start of a new parliament session. “Japan is standing on the verge of whether we can continue to function as a society. Focusing attention on policies regarding children and child-rearing is an issue that cannot wait and cannot be postponed.”

For over a decade, Japan has proactively addressed its rapidly ageing population with a focus on “community-based integrated care.” This system aims to achieve “ageing in place” by providing elderly citizens with a seamless blend of healthcare, preventative measures, social services, and housing support within their communities.

While “community-based integrated care” has mitigated challenges, the picture beyond 2040 looks more complex. An even steeper decline in birth rates, a larger “super-aged” population (those 80+), and overall population shrinkage are anticipated. Additionally, health disparities between elderly groups are expected to widen, and local support systems may struggle under the strain.

Transforming Care: The ‘Mutually-Supportive Community’

To combat these future hurdles, the government has proposed the “mutually-supportive community” concept. This vision moves beyond traditional care models by fostering collaboration across generations within communities.

Instead of siloed systems with ‘providers’ and ‘receivers,’ the goal is to create a networked approach where everyone contributes resources and support.

The framework for this transformation hinges on four key pillars:

Empowering Regions: Strengthening the ability of local communities to address their specific needs.

Building Connections: Fostering collaboration across various sectors and age groups within a region.

Community-Driven Support: Building on the strengths of existing community networks to provide comprehensive care.

Maximising Nursing Expertise: Optimising the vital role of nursing professionals in supporting the elderly population.

By proactively shaping care models and creating a culture of community collaboration, Japan aims to ensure a dignified and supported ageing experience for its citizens, even as its demographics continue to shift.

Source: Earth.org

‘Silver Lining’: The Age-Free Society

Japan faces a unique challenge: a rapidly shrinking workforce due to low birth rates and an ageing population. Projections suggest the proportion of people aged 65 and over will balloon from 28% to 38% by 2050.

However, this demographic shift can be an opportunity for reform and innovation.

The government’s vision of an “age-free society” goes beyond mere policy. It’s a cultural shift that reframes ageing as a positive force, dismantling the stereotype of senior citizens as solely retired and dependent.

This could lead to:

Higher savings rates: A healthier, working older population might contribute to higher savings, benefiting the economy.

Reduced healthcare costs: Investing in preventative healthcare can lower the long-term burden on healthcare systems.

Increased foreign direct investment: A vibrant, age-inclusive workforce could be an attractive proposition for foreign investment.

By embracing these reforms and fostering a culture of lifelong productivity, Japan can turn its demographic challenge into an engine for economic growth and a more inclusive society.

For more such in-depth insights, follow Comms8 where we help your brand expand into foreign markets.

At Comms8, we specialise in helping businesses leverage the power of cross-border marketing in Asia. With our expertise, we can assist you in harnessing the influence of marketing strategies to boost your brand’s credibility and awareness. Contact us today to learn more about empowering your brand in the dynamic Asian market.