South Korea’s Digital Leap: How Local Apps are Shaping the Future in 2024

South Korea, with a population of around 51 million, boasts an impressive internet penetration rate. As of January 2024, there were an estimated 50.30 million internet users in the country, translating to a penetration rate of nearly 98.6%. This widespread internet access extends even to older demographics, with over 50% of Koreans aged 60 or above actively using the internet.

This tech-savvy population fuels a booming e-commerce sector in South Korea. Despite having a smaller population compared to countries like the United States, South Korea’s high internet usage makes it a major player in the global e-commerce landscape.

South Korea’s Ranking in Global Internet Speed Indexes:

Mobile Speeds: South Korea currently boasts the 3rd fastest mobile internet speeds in the world according to Speedtest Global Index (as of April 2024) with a median download speed of around 294.53 Mbps.

Broadband Speeds: While still impressive, South Korea ranks slightly lower in fixed broadband speeds at 25th globally with a median download speed of around 160.59 Mbps.

The Role of Government Policies:

South Korea’s exceptional internet infrastructure and high penetration rate can be attributed in part to several key government policies:

Early Investment: The government heavily invested in building a nationwide fiber optic network starting in the 1990s, laying the foundation for the country's high internet speeds.

Competition: The government fostered competition among internet service providers (ISPs) which helped drive down prices and improve service quality.

Digital Literacy Programs: Initiatives to educate citizens on using the internet effectively further boosted national usage rates.

Focus on Innovation: Government support for research and development in the tech sector has fostered a culture of innovation, contributing to advanced internet technologies.

These policies, combined with a cultural emphasis on technology and education, have positioned South Korea as a global leader in internet access and usage.

Source: Asia Pac Digital

South Korea: A Powerhouse in E-Commerce

Did you know South Korea is now the world’s sixth-largest e-commerce market, surpassing France with annual revenues surpassing $92 billion? Yes, it’s true. The country reigns supreme in per capita online spending, with consumers shelling out an impressive $2,713 annually in 2021 – nearly triple the estimated amount spent in Japan.

This dominance can be attributed to several factors:

High Internet Penetration: Boasting a remarkable 98% internet penetration rate, South Korea has a population primed for online shopping, as per an eCommerceDB report.

Explosive Growth: E-commerce sales have skyrocketed since 2010, experiencing a staggering 20% annual average growth. Moreover, the sales are now touching a value of $164 billion in 2021, compared to just $30 billion in 2012.

Mobile Commerce Boom: Mobile transactions are a major driver, accounting for a whopping 75% of the total online shopping value in 2022. This trend is expected to continue, with over 37% of mobile users having 4 to 6 shopping apps installed on their phones.

Convenience is King: Platforms like coupang.com, known for its next-day delivery, exemplify the emphasis on convenience that fuels South Korea’s e-commerce success.

In short, South Korea’s e-commerce landscape is thriving, thanks to high internet access, a tech-savvy population, a preference for mobile shopping, and a culture that prioritises convenience.

Source: Comms8

A Look at South Korea’s Smartphone Obsession

South Korea isn’t just keeping up with the digital age; it’s leading the charge.

The country boasts blazing-fast internet speeds, with mobile connections reaching an impressive 136.4 Mbps in early 2024. This, coupled with a near-universal smartphone ownership rate, reflects a deep integration of technology into everyday life.

From banking and shopping to ticketing and payments, smartphones are an essential tool. A staggering 94.8% of South Koreans reported having a smartphone in 2023, compared to just 22% in 2011. However, this dependence comes at a cost. Over 23% of smartphone users in 2022 were considered overly reliant on their devices.

Looking ahead, South Korea aims to be a major player in future smartphone advancements. Android is the national preference in the country, and nearly 55% of Koreans are willing to exchange personal data for free services.

Cashwalk, a mobile app that incentivises walking with rewards, has garnered significant traction in South Korea, surpassing 10 million downloads. This impressive milestone reflects South Korea’s unique blend of factors:

Tech-Savvy Population: South Korea boasts a high smartphone penetration rate and a population comfortable using mobile apps. Cashwalk capitalises on this tech-savvy base, offering a convenient way to earn rewards through everyday activities.

Culture of Walking: Walking is a popular mode of transportation and leisure activity in South Korea. Cashwalk gamifies this existing habit, motivating users to walk more and potentially improve the overall public health

Rewarding System: The core appeal of Cashwalk lies in its ability to convert steps into redeemable rewards. This taps into the desire for value exchange that many Koreans are open to.

Cashwalk’s success in South Korea highlights the potential of apps that merge fitness incentives with daily activities. This is likely due to a few reasons:

Convenience: Many popular apps in South Korea offer features and services for free in exchange for user data. This can be a convenient way for users to access these services without having to pay for them.

Trust: South Korea has a relatively high level of trust in businesses and institutions. This may make users more willing to share their data with them.

Regulation: While South Korea is open to data exchange, it also has regulations in place to protect user privacy. The Personal Information Protection Act (PIPA) makes it crucial for businesses to explain the purpose of collecting personal data and to take consent separately for each purpose.

South Korea made history on April 3, 2019, by becoming the first nation to launch commercial 5G services. Today, SKT stands out as the leader, boasting over 15 million subscribers, with KT and LGU+ close behind.

This rapid adoption is evident in the impressive 19.3% year-over-year growth in usage and reflects South Korea’s unwavering commitment to staying at the forefront of technological innovation. Their success in rolling out 5G establishes them as the global leader in telecommunications, setting a high bar for others to follow. With the clear upward trend, South Korea is shaping the future of connectivity for years to come.

Source: Comms8

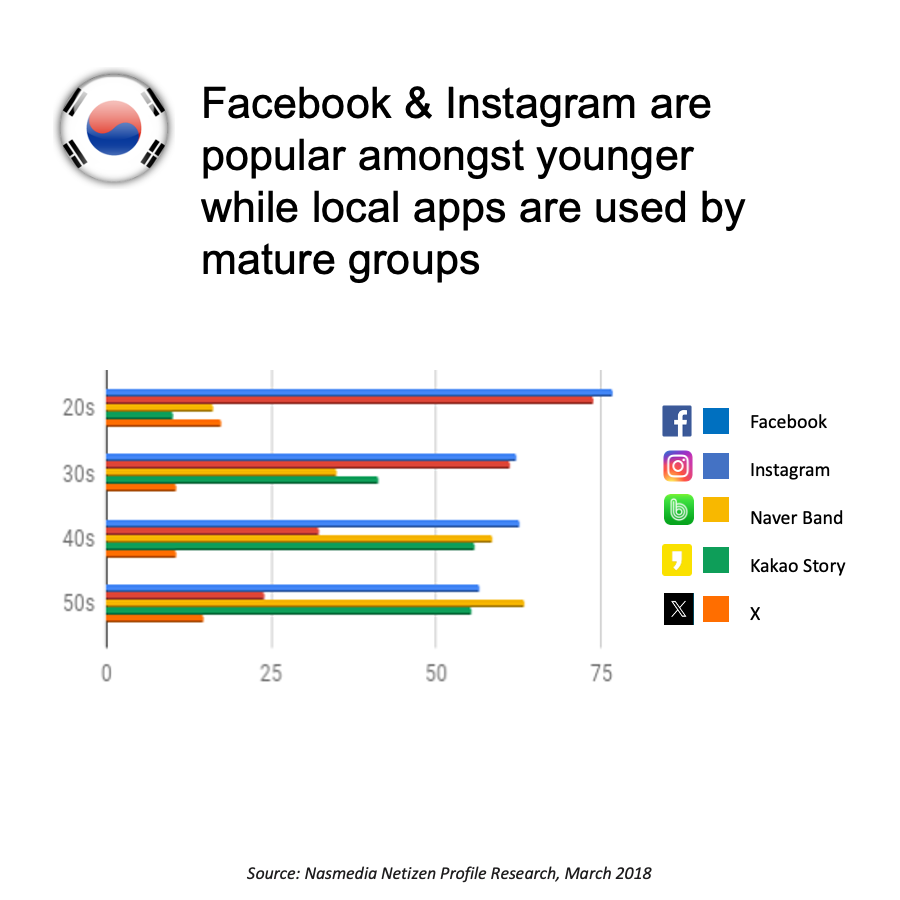

Most Used Social Media Platforms In Korea

96.1 percent of the Republic of Korea’s total internet user base (regardless of age) used at least one social media platform in January 2024. According to a survey, 49.8 percent of South Korea’s social media users are female, while 50.3 percent are male.

While Facebook and Instagram are popular among the youth, their reach pales in comparison to KakaoTalk. YouTube, however, enjoys strong adoption with over 44 million users. Here’s a breakdown of the most-used social media platforms in Korea.

KakaoTalk

As of early 2024, KakaoTalk boasts an impressive 48.34 million monthly active users (MAUs) in South Korea, according to the company’s investor reports. This translates to nearly all (96.1%) of South Korean internet users actively using the platform.

Interestingly, South Korea is the dominant force behind KakaoTalk's global presence. While it enjoys the top spot as South Korea's leading social media platform, a staggering 90.3% of KakaoTalk's total global MAUs come from South Korea itself.

Here are some statistics you need to know:

High Internet User Penetration: 96.1% of South Koreans actively use KakaoTalk for communication.

Global Reach with Local Focus: While boasting a global presence, a whopping 90.3% of KakaoTalk’s active users hail from South Korea.

Modest Increase YOY: Between the start of 2023 and 2024, KakaoTalk users in South Korea saw a 1.5% growth of a total 699,000 users.

Slow Quarter-to-Quarter Growth: User numbers grew by a more modest 130,000 users (+0.3%) from October 2023 to January 2024.

Meta’s data suggests a potential decrease of 1.2 million users in ad reach (-12.5%) between January 2023 and 2024. Looking at a shorter timeframe, ad reach numbers might have dropped by 300,000 users (-3.4%) from October 2023 to January 2024.

Ad reach data doesn’t necessarily reflect changes in Facebook’s total user base due to factors like multiple accounts and user demographics. Here are some stats to know:

Percentage of Population: Facebook's ad reach covered 16.2% of South Korea’s total population in early 2024.

Penetration Among Eligible Users: Considering only users over 13, Facebook reached 17.9% of this “eligible” audience.

Internet User Penetration: Facebook’s ad reach encompassed 16.7% of South Korea’s internet users of all ages.

Gender Breakdown: As of early 2024, Facebook’s ad audience in South Korea skewed slightly male (61.9%) compared to female (38.1%).

YouTube

YouTube’s ad reach covered a staggering 85.6% of South Korea’s entire population in early 2024. Dominating the online video space, YouTube ads reached 88.1% of South Korea’s internet users (all ages) at the start of the year.

Here are some statistics you’d like to know:

Yearly Decrease: Google’s data suggests a potential decline of 1.7 million users in ad reach (-3.7%) between January 2023 and 2024.

Stagnant Short-Term Trend: Interestingly, ad reach figures remained flat between October 2023 and January 2024.

Gender Distribution: YouTube ad reach boasted a near even split between female (49.8%) and male (50.3%) users.

Surpassing Global Averages: South Korean YouTube users demonstrate exceptional engagement, averaging nearly double the global monthly viewing time (excluding China) as of early 2024.

Instagram’s ad reach covered a substantial 45.2% of South Korea’s entire population in early 2024. Recording a high penetration among eligible users, the photo and video-sharing platform reached a significant 49.9% of audience when considering only users over 13.

Here are some stats you’d like to know:

Strong Online Presence: Instagram ads reached 46.5% of South Korea’s internet users (all ages) at the start of the year.

Female Dominance: The ad audience in South Korea skewed female (56.7%) compared to male (43.3%) in early 2024.

Impressive Yearly Increase: Instagram’s ad reach saw a significant rise of 4.2 million users (+21.6%) between January 2023 and 2024.

Modest Quarterly Growth: Ad audience size also grew by 300,000 users (+1.3%) from October 2023 to January 2024.

TikTok

ByteDance’s advertising data shows users aged 18 and above reaching up to 6.95 million in early 2024, ad reach suggests TikTok reaches almost 15.6% of adults and 13.8% of all internet users among South Korea’s adult population.

Here are some stats you should know:

Gender Breakdown: The ad audience in South Korea is nearly balanced between genders (49.7% female, 50.3% male).

Total Reach: Ad reach on TikTok in South Korea has grown steadily, with a 23% increase between 2023 and 2024.

Content Trends: Dance challenges and comedic skits remain popular content categories on TikTok in South Korea.

Local vs. Global Reach: While Korean content creators are highly successful, South Korean users also enjoy engaging with global trends and challenges.

Source: Comms8

Naver vs. Google: What’s more popular in South Korea?

Google dominates global search with a staggering 90% market share, but South Korea has broken that trend. Here, Naver reigns supreme, with a 51% market share, followed by Google at 41%.

This dominance can be attributed to several key factors.

Focus on the Local Landscape: Unlike Google’s global approach, Naver prioritises the Korean market. This laser focus allows them to tailor their services and features to Korean user preferences and linguistic nuances.

A Suite of Localised Services: Naver goes beyond just search, offering a comprehensive ecosystem of Korean-centric services. This integrated approach caters to various needs, from social media with Naver Cafe to online shopping with Naver Shopping Live.

Mastering the Korean Language: The Korean language presents unique challenges for search engines. With complex grammar, homonyms, and cultural context, accurate understanding is crucial. Naver’s algorithms excel here, prioritising context and user intent to deliver superior Korean search results. Meanwhile, Google hasn’t yet fully bridged this gap.

Powerful Brand Recognition: Through constant innovation and a deep understanding of Korean user needs, Naver has become a household name in South Korea. Their commitment to the local market and cultural nuances fosters a level of trust and user loyalty that Google struggles to match.

Gaining traction on Naver, South Korea’s dominant search engine, is crucial for success. Beyond its domestic importance, South Korea's trendsetting influence in tech, fashion, beauty, and entertainment makes it a strategic gateway to the wider Asian market. Brands finding success in Korea are well-positioned for broader Asian expansion.

Source: Comms8

South Korea boasts a robust economy, ranking 12th globally with a GDP of $1.5 trillion. Korean consumers stand out in Asia for their tech-adoption and eagerness to embrace new trends. This presents a significant untapped opportunity for international brands.

However, navigating the Korean market poses its own challenges. Cultural nuances and traditions can be a hurdle for international companies. Additionally, the digital marketing landscape is complex, with limited agencies specialising in navigating it effectively. The language barrier, coupled with a hyper-localised search engine environment, further complicates entry.

Despite these hurdles, the right partner can empower international brands to test the waters. By partnering with a local expert, brands can localise their marketing strategy and test the market before fully committing to incorporation.

For more such in-depth insights, follow Comms8 where we help your brand expand into foreign markets.

At Comms8, we specialise in helping businesses leverage the power of cross-border marketing in Asia. With our expertise, we can assist you in harnessing the influence of marketing strategies to boost your brand’s credibility and awareness. Contact us today to learn more about empowering your brand in the dynamic Asian market.