Louis Vuitton's Shanghai Campaign: Merging Luxury, Local Tides and China’s Middle Class

Louis Vuitton (LV) sparked a vibrant discussion on Chinese social media platforms recently with its co-branding project, 'Librairie Éphémère,' in Shanghai. Partnering with three boutique coffee shops—Manner, Metal Hands, and Plusone—LV transformed these locales into creative book kiosks. They showcased LV's "Travel Book" "City Guide" and the "Fashion Eye" series, in a bid to promote their range of travel and fashion books. However, the campaign has stirred up a fascinating debate regarding its delivery, the value it presents, and the shifting landscape of consumer trends in post-Covid China.

Message Misdelivery and the Tote Bag Fiasco

The campaign attracted considerable attention soon after its launch, with the hashtag "LV Bookstore" amassing over 168,800 views on Rednote (Xiaohongshu / RED). However, the promotional gift—a tote bag with LV’s logo — sparked a flurry of debates on Weibo. The tote bag, offered for purchases of over two books, equalling at least 580 RMB, quickly eclipsed the campaign's core message. Crowds lined up for hours, less to explore the books' content, and more to take photos, buy books, and, most importantly, secure the coveted tote bag. The bag's appeal was so overpowering that it almost completely distracted the intended focus of the campaign. This shift in focus was acutely reflected on Weibo, where users engaged in intense debates. Satirical posts mocked consumers who fell prey to the allure of affordable luxury, accusing them of missing the forest for the trees. Critics also accused LV of exploiting the desires of lower-income consumers.

source: Rednote (Xiaohongshu / RED)

Meanwhile, scalpers and counterfeit merchants seized the opportunity, causing the tote bag's resale price to soar to nearly 1000 RMB while pirated versions sold for as little as 20 or 30 RMB. This intensified the debates on social media platforms. Unanticipated negative comments on social media platforms not only disrupted the intended delivery of the campaign's message but also cast a shadow over the brand's image. But how does this go wrong?

Debating Value and the Rise of a New Generation of Consumers

LV’s campaign revealed several insights into how value is perceived within the luxury market, particularly by the younger generations. Today's driving forces for domestic demand for luxury goods are primarily Generation Z and Millennials. They are not just consumers but are becoming pivotal influencers in the luxury market. A key point to highlight is the finding from a KPMG survey. It indicated that 21% of Gen Z respondents, who are generally recent graduates or individuals newly entering the job market, are willing to part with more than 16% of their income for luxury goods. This is a significant indication of their financial prioritisation.

source: Rednote (Xiaohongshu / RED)

Looking at the response to the LV campaign, it is apparent that these young consumers see the co-branded LV tote bag not just as a product but as a form of social currency. This 'ticket' to the middle class is a symbol of their aspirational progression towards a certain lifestyle - the allure of sophistication associated with middle-class consumerism.

The campaign, on the other hand, resonated differently with existing luxury consumers. This group is generally characterized by their social consciousness and environmental awareness. They saw the tote bag not just as a lower-priced item but as an embodiment of the brand's values.

These divergent perceptions indicate that value in the luxury market is complex, shaped by various factors including socio-economic standing and personal beliefs. The campaign, in its controversy and discussions, underlined a pivotal reality: value perception varies widely across consumer groups and it often mirrors an interplay of socio-economic context, personal values, and societal expectations.

Middle-class Consumption Trends in Post-Covid China

According to BCG’s report, China's middle and upper classes are projected to expand by over 80 million by 2030, making up 40 per cent of the country's total population. These burgeoning middle-class consumers are becoming a substantial part of China's appealing consumer market. Their quest for a sophisticated, high-quality lifestyle is influencing prevailing trends and becoming an aspirational benchmark for many younger individuals. The LV campaign became a social media sensation, especially on platforms like Rednote (Xiaohongshu / RED). The campaign's central theme — an urban, modern lifestyle epitomised by the City Guide series — aligns with the platform's focus on showcasing an upscale, middle-class lifestyle. Despite some criticism, depicting this lifestyle attracts vast audiences, thereby magnifying the campaign's reach.

However, the optimistic forecast of middle-class growth in China faces challenges due to shifts in the country's economy. As job cuts affect urban families, the path to middle-class status is becoming more difficult, adding pressure to those already in this bracket. According to Wind's 2022 survey of A-share listed companies, approximately 10% of the active workforce, amounting to around 25 million people, faced redundancy or unemployment challenges. Notably, tech giants like Tencent, Meituan, and Baidu reported layoff rates of about 9%.

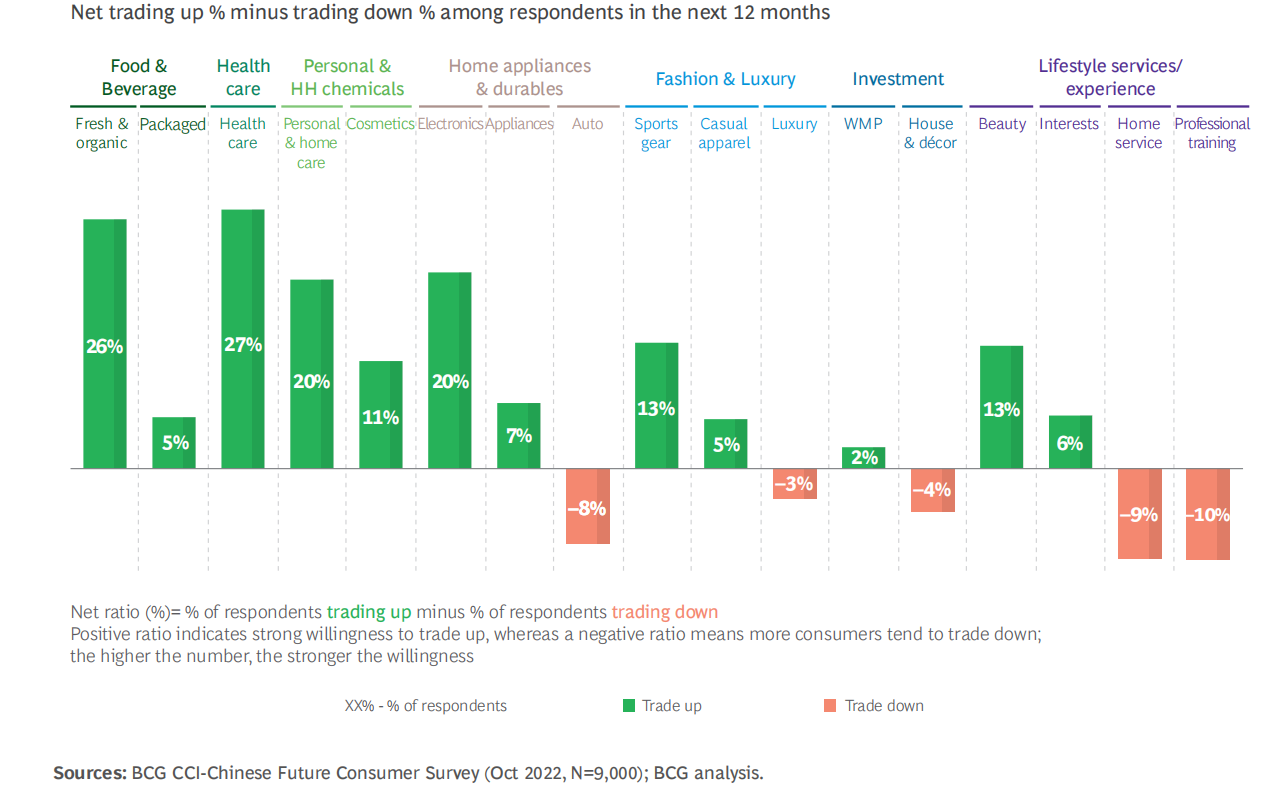

The BCG survey indicates that consumers' intentions to spend less on luxury have risen by 3 percentage points, revealing a conservative approach towards expenditure. The demand for "pseudo-luxury" and "light luxury" items is dwindling, with consumers focusing more on quality, practicality, and safety.

As the middle-class grapples with economic shifts, consumers are more price-sensitive and exhibit complex emotions towards luxury brands. Therefore, understanding and catering to this nuanced consumer sentiment will be critical for luxury brands, as they strive to appeal to a range of consumers — from luxury loyalists to the emerging middle class — amid shifting consumption habits and market dynamics.

Navigating Brand Localisation and Successful Co-branding

China's economic shifts and changes in consumer behaviours pose challenges to brand collaboration and localisation strategies. Co-branding campaigns are a powerful means for brands to integrate into local cultures and establish deeper connections with consumers. As highlighted by a luxury industry marketing expert, successful collaborations require a brand to possess a unique identity, maintain aesthetic consistency, and exude an appeal that resonates with the target audience. Simultaneously, brands need to stay true to their identities while considering the economic conditions and evolving consumption habits of their customers.

A powerful example of this strategy is the collaboration between Fendi and Heytea. The brands created a high-value proposition by offering a Fendi-branded paper bag with a relatively affordable Heytea drink package. This co-branding initiative was executed in a way that felt authentic and didn't dilute either brand's core identity. Moreover, it was well-aligned with the expectations and consumption habits of the local consumers, who took to social media in droves to express their enthusiasm. The resultant buzz generated significant attention for Fendi, particularly among younger consumers.

The juxtaposition of LV’s and Fendi’s campaigns underscores the importance of a clear, consistent brand message in co-branding initiatives. While both campaigns reached a large audience, Fendi and Heytea's collaboration resulted in more positive engagement due to its strategic alignment with consumer expectations and the careful preservation of each brand's identity.

Piecing Together the Complexities of the Chinese Market

LV's Shanghai campaign offers a fascinating case study of luxury branding, local collaboration, and the evolving Chinese consumer landscape. While the campaign sparked controversy, it opened up discussions about the complexities of value perception, the rise of a younger generation of consumers, and the shifts in middle-class consumption habits in the wake of Covid-19. For brands looking to navigate this intricate market, understanding these dynamics will be crucial in crafting successful and resonant strategies.

At Comms8, we excel in guiding brands through the complexities of the Chinese market. We create customized strategies, that resonate with your target audience, and align with evolving consumer trends and cultural nuances. Get in touch today to discover how we can help your brand engage effectively with Chinese consumers.